Central Bank

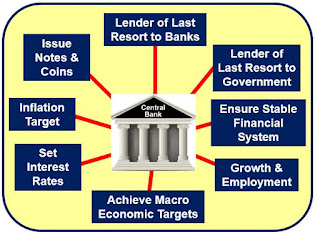

A Central Bank is the bank in any country to which has been entrusted the duty of regulating the volume of currency and credit in that country”-Bank of International Settlement.

The central bank is the apex institution of a country’s monetary system. The design and the control of the country’s monetary policy is its main responsibility. India’s central bank is the Reserve Bank of India.

Functions of Central Bank.

(a) Currency Authority:

(i) The central bank has the sole monopoly to issue currency notes. Commercial banks cannot issue currency notes. Currency notes issued by the central bank are the legal tender money.

(ii) Legal tender money is one, which every individual is bound to accept by law in exchange for goods and services and in the discharge of debts.

(iii) Central bank has an issue department, which is solely responsible for the issue of notes.

(v) For example, in India, one rupee notes and all types of coins are issued by the government and all other notes are issued by the Reserve Bank of India.

(b) Banker, Agent and Advisor to the Government:

(i) As a custodian of the cash reserves of the commercial banks, the central bank maintains the cash reserves of the commercial banks. Every commercial bank has to keep a certain percent of its cash reserves with the central bank .

• As banker to the banks, the central bank acts as the lender of the last resort.

• In other words, in case the commercial banks fail to meet their financial requirements from other sources, they can, as a last resort, approach to the central bank for loans and advances.

(ii) As Clearing Agent

• Since it is the custodian of the cash reserves of the commercial banks, the central bank can act as the clearinghouse for these banks.

• Since all banks have their accounts with the central bank, the central bank can easily settle the claims of various banks against each other simply by book entries of transfers from and to their accounts.

(b) Supervisor

(i) The Central Bank supervises, regulate and control the commercial banks.

(ii) The regulation of banks may be related to their licensing, branch expansion, liquidity of assets, management, amalgamation (merging of banks) and liquidation (the winding of banks).

4. Controller of Money Supply and Credit:

(a) Quantitative Instruments or General Tools; and

(b) Qualitative Instruments or Selective Tools.

(i) Bank Rate (Discount Rate)

• Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to general public.

• In a situation of excess demand leading to inflation,

-> It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

-> Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

-> Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

• In a situation of deficient demand leading to deflation,

-> Central bank decreases bank rate that encourages commercial banks in borrowing from central bank as it will decrease the cost of borrowing of commercial bank.

-> Decrease in bank rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

-> Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

-> Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(ii) Repo Rate

• Repo rate is the rate at which commercial bank borrow money from the central

bank for short period by selling their financial securities to the central bank.

• These securities are pledged as a security for the loans.

• It is called Repurchase rate as this involves commercial bank selling securities

to RBI to borrow the money with an agreement to repurchase them at a later

date and at a predetermined price.

• So, keeping securities and borrowing is repo rate.

• In a situation of excess demand leading to inflation,

-> Central bank raises repo rate that discourages commercial banks in borrowing from central bank as it will increase the cost of borrowing of commercial bank.

-> It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

-> Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

-> Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

• In a situation of deficient demand leading to deflation,

-> Central bank decreases Repo rate that encourages commercial banks in borrowing from central bank as it will decrease the cost of borrowing of commercial bank.

-> Decrease in Repo rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

-> Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

-> Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(iii) Reverse Repo Rate

• It is the rate at which the Central Bank (RBI) borrows money from commercial bank.

• In a situation of excess demand leading to inflation, Reverse repo rate is increased, it encourages the commercial bank to park their funds with the central bank to earn higher return on idle cash. It decreases the lending capability of commercial banks, which controls excess demand.

• In a situation of deficient demand leading to deflation, Reverse repo rate is decreased, it discourages the commercial bank to park their funds with the central bank. It increases the lending capability of commercial banks, which controls deficient demand.

(iv) Open Market Operations (OMO)

• It consists of buying and selling of government securities and bonds in the open market by Central Bank.

• In a situation of excess demand leading to inflation, central bank sells government securities and bonds to commercial bank. With the sale of these securities, the power of commercial bank of giving loans decreases, which will control excess demand.

• In a situation of deficient demand leading to deflation, central bank purchases

government securities and bonds from commercial bank. With the purchase of these securities, the power of commercial bank of giving loans increases, which will control deficient demand.

(v) Varying Reserve Requirements

• Banks are obliged to maintain reserves with the central bank, which is known as legal reserve ratio. It has two components. One is the Cash Reserve Ratio or CRR and the other is the SLR or Statutory Liquidity Ratio.

• Cash Reserve Ratio:

-> It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank. Commercial banks have to keep with the central bank a certain percentage of their deposits in the form of cash reserves as a matter of law.

-> In a situation of deficient demand leading to deflation, cash reserve ratio (CRR) falls, which will increase the cash resources of commercial bank and increasing credit availability in the economy, which will control deficient demand.

(vi) The Statutory Liquidity Ratio (SLR)

• It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

• In a situation of excess demand leading to inflation, the central bank increases statutory liquidity ratio (SLR), which will reduce the cash resources of commercial bank and reducing credit availability in the economy.

• In a situation of deficient demand leading to deflation, the central bank decreases statutory liquidity ratio (SLR), which will increase the cash resources of commercial bank and increases credit availability in the economy.

• It may consist of:

-> Excess reserves

-> Unencumbered (are not acting as security for loans from the Central Bank) government and other approved securities (securities whose repayment is guaranteed by the government); and

-> Current account balances with other banks.

(b) Qualitative Instruments or Selective Tools of Monetary Policy:

(i) Imposing margin requirement on secured loans

• Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security.

• So, the difference between the value of security and value of loan is called

marginal requirement.

• In a situation of excess demand leading to inflation, central bank raises marginal requirements. This discourages borrowing because it makes people gets less credit against their securities.

• In a situation of deficient demand leading to deflation, central bank decreases marginal requirements. This encourages borrowing because it makes people get more credit against their securities.

(ii) Moral Suasion

• Moral suasion implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

• In a situation of excess demand leading to inflation, it appeals for credit contraction.

• In a situation of deficient demand leading to deflation, it appeals for credit expansion.

(iii) Selective Credit Controls (SCCs)

• In this method the central bank can give directions to the commercial banks not to give credit for certain purposes or to give more credit for particular purposes or to the priority sectors.

• In a situation of excess demand leading to inflation, the central bank introduces rationing of credit in order to prevent excessive flow of credit, particularly for speculative activities. It helps to wipe off the excess demand.

• In a situation of deficient demand leading to deflation, the central bank withdraws rationing of credit and make efforts to encourage credit.

Excellent presentation

ReplyDeleteExcellent presentation.

ReplyDelete